My targets are clear, quantified, and higher than ever.

Last year I made the case for setting New Year’s goals and resolutions, explaining that most critiques or dismissals of goal-setting amount to a failure to recognize that goals must be measurable.

Putting it bluntly, if your goals aren’t quantifiable, they’re a waste of time. And yes, the cliches apply. Goals like “eating healthier” don’t make it past the second week of January. They’re meaningless because the success criteria isn’t clearly defined.

So with quantities in mind, I’m looking for big results this year. I’m hoping that by sharing these targets, you might be encouraged and inspired, too!

Here are my 2019 goals, by the numbers.

Physical

- Work out at Anytime Fitness 156+ times.

- Run a total of 156+ km. Now that I have a weekly running partner, this one might get blown out of the water. But years of inconsistency in this area make me cautious.

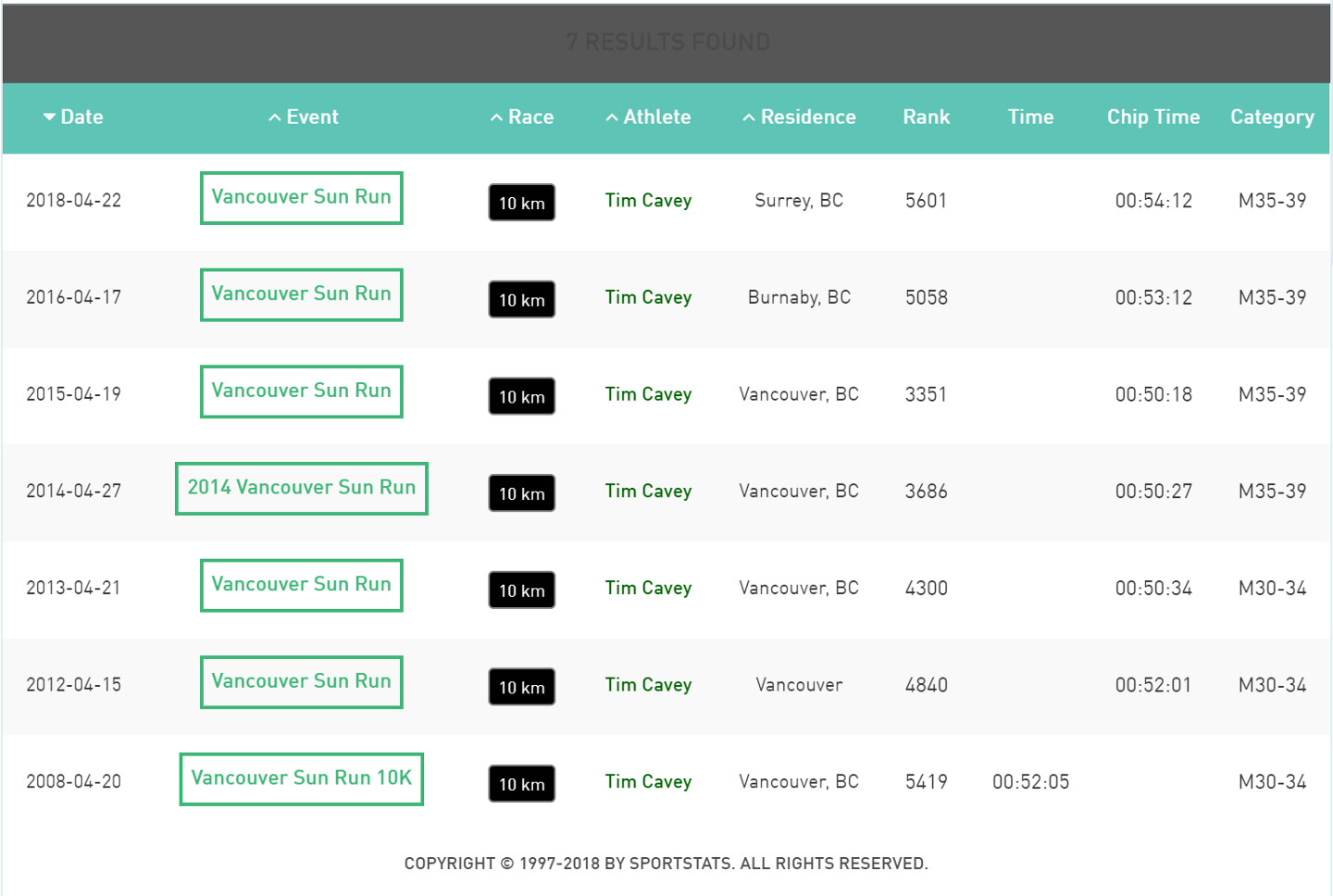

- Run the 10 km (6.2 miles) Vancouver Sun Run in <50 minutes with 40,000 other runners. The under-50 time has been an elusive goal for the last decade. I was 0:19 away in 2015.

- Complete 42 push-ups in one set.

- Complete 15 reps of 135 pounds on the bench press.

- Continue diet of no French fries, chips, or non-alcoholic sugary drinks.

- Monitor and maintain optimal blood pressure averages for 2018.

- End 2019 at 179 lbs (I’m currently 188).

Self-Improvement

- Read 15 books on my Kindle. Connect with me on Goodreads to see what I’m reading!

- Write 104+ blog posts.

- Purge 1+ clothing item/week.

- Complete 104+ bedtime journal entries (handwritten).

- Complete 104+ morning reflection and prayer journal entries.

Financial

- Pay off our HELOC (home equity line of credit) by an average of $500/month. This thing has been in existence since we purchased our home in 2015, and it’s time to make some serious progress.

- Earn an average of $50/month or from Medium publishing and other online activities.

- Give $5 more per month to charitable organizations. We currently donate above 10% of our net incomes but less than 10% of our gross. The plan right now is to continue increasing our giving by $5/month to continue nudging that upward. Ultimately this speaks to our intention to live more and more generously, holding on loosely to the resources we’ve been given.

Paternal

- Read with the boys one night/week before bed.

- Complete monthly stepdad-stepson date nights.

- Enjoy 36+ Friday Family Fun Nights.

Professional

- Complete M. Ed. degree.

- Grow the Teachers on Fire podcast to 500+ downloads/episode.

Social/Relational

- Organize 10+ monthly father-son conference calls (I’m speaking here of my own father and three brothers.)

- Complete a third annual father-son summer camping trip with one of my brothers and his son.

- Meet 10+ times with a close friend and goals accountability partner. We’ll be talking about this very list each month and updating our progress.

Marital

- Complete 36 Connect Times with my wife. Connect Time is what we call weekend meetings where we sit down together to complete a thorough review of our current spending, financial picture, calendars, event planning, pressing decisions, other discussion items, and the health of our relationship. Connect Time is agenda-driven and methodical, but once we’re finished these meetings we feel in sync and settled.

- Write 12 handwritten notes (1/month) to my wife. By no means should this be the sum total of my romance, but a friend suggested this one and I like it.

- Make love regularly. We do have numerical goals here, but that’s TMI. Ha!

There you have it — my goals for 2019. Again, I’m posting them here partly to channel the power of public accountability, and partly to encourage and inspire you in your own goal-setting.

It’s 2019, people. Don’t wait for life to happen to you — make the decision to happen to life!

Let’s do this.