We’re half-way through the year, and 2022 is becoming a distant memory.

I am NOT a pro investor.

My wife and I both contribute to healthy pension plans through our employers, but if you believe Dave Ramsey, that’s not enough to assure anyone of a comfortable retirement. Do more, he encourages.

Two years ago, we agreed to start making modest monthly 3-figure contributions to our TFSAs (Roth IRAs for my American friends) through QTRade.com (which charges a $10 flat rate per trade), and we’ve kept it up faithfully ever since.

We didn’t know much about stock trading. But we were excited to learn.

Picking single stocks (as opposed to mutual funds, ETFs, indexes, or other collections) is not for the faint of heart. Prices can rise and fall precipitously based on changing economic conditions outside of anyone’s control.

And I’ll be real: the steady decline across the markets in 2022 was not fun. But instead of worrying endlessly, we simply decided to sit tight and ignore the daily news. We refused to sell, and we’ve been rewarded by the comeback of 2023 that you’ll see below.

No, you don’t need to do a ton of market analysis before buying stocks. One rule has stood me well: invest in companies that you know, like, trust, and use every day. By and large, you’ll see that theme appear often in the stocks below.

We’re half-way through the year, which means it’s a good time to give my portfolio a close review. Not every stock has been a winner, but my overall portfolio is doing well thanks to these companies.

Without further ado, here are my biggest winners of the year so far (ranked by percentage gains to date in 2023).

Five stocks that are carrying my portfolio

TSLA — Tesla

- $211.94 USD/share: my average purchase price (prior to 2023)

- $108.10 USD/share: market price on January 3, 2023

- $265.28 USD/share: current market price

- Gain/loss of the stock to date in 2023: +145.40%

- Gain/loss on my personal investment: +25.2%

- Dividend yield: none

Can you say WOW? Tesla’s rise this year is simply stunning.

Remember: you’ll do well to buy the brands that you know, like, and trust. My wife and I are three years into our Model 3, and this car is still a treat to drive every day. We believe in this company and its future.

When you zoom out to the five-year view on this stock, you’ll see that Tesla’s last three years have been a wild ride of ups and downs. At its peak in November 2021, Tesla hit a (split-adjusted) price of $407.36/share. From there, 2022 saw a steady decline in the share value as Tesla missed a number of expectations and Elon Musk appeared distracted by the acquisition of Twitter.

But 2023 has been all comeback. For mega-investors like Cathie Wood, who bought large shares of Tesla stock when it dipped close to $100/share in January, it’s been a good year.

Why didn’t we buy more shares ourselves? Well, it’s the uncertainty of the markets, I guess. Nothing is a sure thing.

But going back to my rule of investing in the big companies that we know, like, trust, and use every day, we won’t make that same mistake twice.

PMET — Patriot Battery Metals, Inc.

- $4.08 CAD/share: my average purchase price

- $5.69 CAD/share: market price on January 3, 2023

- $13.32 CAD/share: current market price

- Gain/loss of the stock to date in 2023: +134.09%

- Gain/loss on my personal investment: +226.5%

- Dividend yield: 0.50%

It’s been a fun ride with Patriot Battery Metals, a small Canadian mining company with a focus on lithium (an important mineral in the car battery industry). Sadly, when a relative advised me to get in on Patriot when the stock was under $0.30/share, I was reluctant to move. Once the stock grew from there to $4.00/share, I swallowed my chagrin at the profits missed and finally purchased. It continues to grow.

As you can see, this stock has not produced a steady climb, so my wife (who also owns shares) and I don’t watch prices here too closely. That said, we’d love to see Patriot return to its high of $17.53/share set in June of 2023.

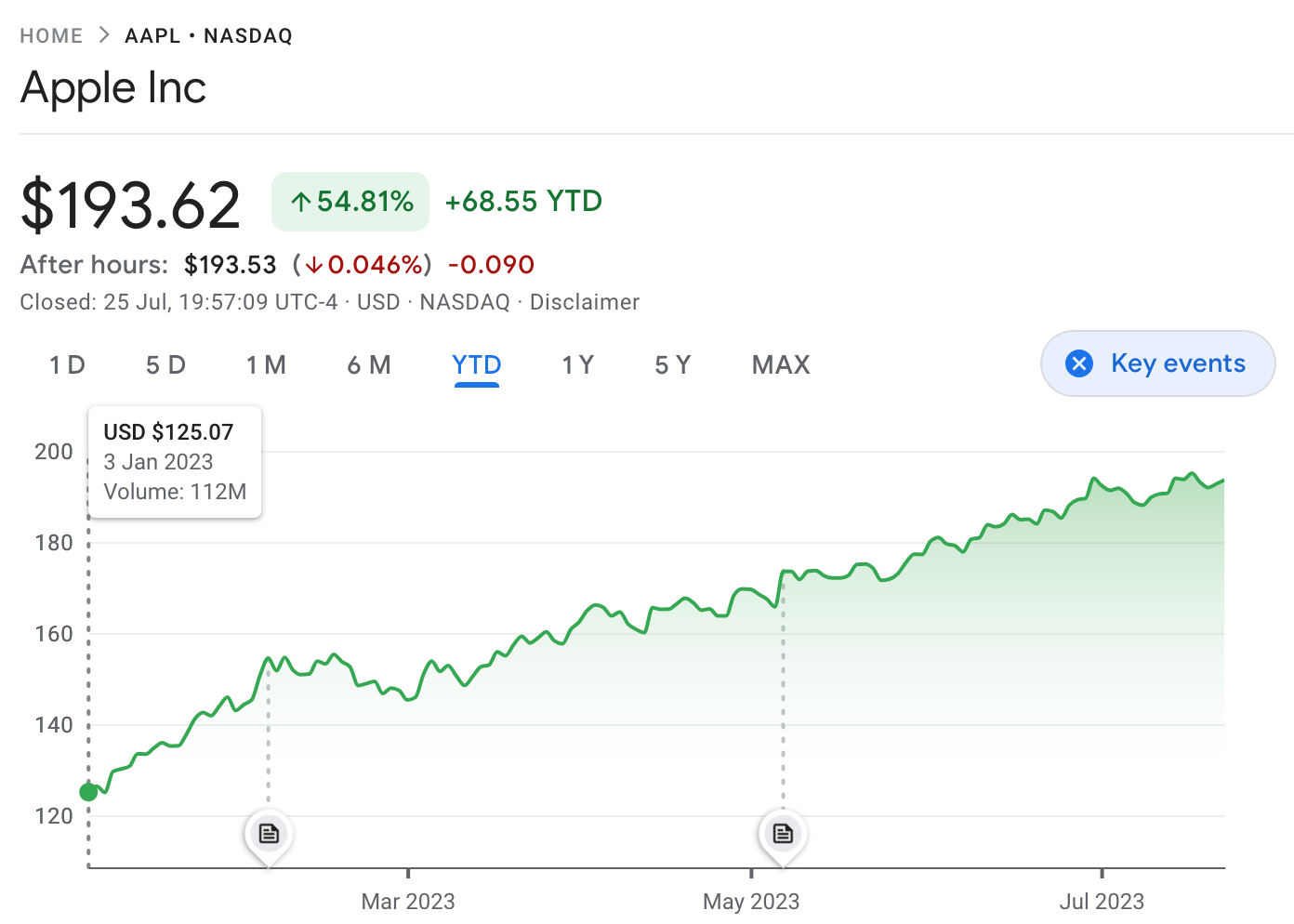

AAPL — Apple

- $130.05 USD/share: my average purchase price (prior to 2023)

- $125.07 USD/share: market price on January 3, 2023

- $193.62 USD/share: current market price

- Gain/loss of the stock to date in 2023: +54.81%

- Gain/loss on my personal investment: +48.9%

- Dividend yield: 0.50%

Remember when the doubters predicted that Apple would tank after Steve Jobs left the company? Fun times.

Apple is the largest company in the world by market cap and continues to lead the way in terms of quality and reliability. I’m currently writing on a Macbook Pro and sitting with an iPhone 13 Pro, an Apple Watch, and AirPods. I’m all in on Apple.

How long will Apple’s ascent continue before it hits a significant trough? For the time being, Apple investors are watching closely to see if the stock can break $200/share.

GOOGL — Alphabet (Google)

- $108.40 USD/share: my average purchase price (prior to 2023)

- $89.12 USD/share: market price on January 3, 2023

- $122.21 USD/share: current market price

- Gain/loss of the stock to date in 2023: +37.13%

- Gain/loss on my personal investment: +12.7%

- Dividend yield: none

Google is yet another brand that I know, love, and use every day. I am writing this blog post in Google Docs, for example. I spend time in the Google Workspace every day without fail in both my personal and professional lives.

As the fourth largest company in the world, this monster’s continued growth seems assured. With a host of services that the world relies on every day, it’s not going anywhere.

Even with a gain of 37% on the year, I consider this a safe investment for the indefinite future. That said, would I like to see something new, bold, and innovative from this company? Yes.

AC — Air Canada

- $23.36 CAD/share: my average purchase price (prior to 2023)

- $19.12 CAD/share: market price on January 3, 2023

- $24.51 CAD/share: current market price

- Gain/loss of the stock to date in 2023: +28.24%

- Gain/loss on my personal investment: +4.9%

- Dividend yield: none

I first bought Air Canada shares at the heart of COVID times, thinking a major bounce-back after the pandemic was all but inevitable once the pandemic was over (shares sat at $51.08 in January 2020, so I figured they would make their way back to those heights quickly).

That comeback has been slow, but the word from the airlines is that customers are BACK. Air Canada recently boosted its earnings forecast for 2023, and I expect this climb to continue.

What’s winning for you right now?

Western markets have been defying the doomsday recession predictions so far this year. Will this trend continue for the rest of the year? And which companies have performed well for you? Let me know.